As a business owner who has spent three decades in the contract manufacturing service industry (primarily in the US while briefly once dipping my toe into China sourcing before quickly pulling it back out), I have made sales pitches to a wide variety of businesses both large and small. What is surprising is the general lack of understanding of real costs companies incur while procuring custom fabricated parts and assemblies from their supply chain partners. This TOTAL COST goes well beyond the price per unit. Often times the companies that have chosen offshore sourcing have either opted to save money on lesser experienced supply chain management personnel, or their execs have fallen for misleading sales pitches from consulting firms whose end goal is to leverage communist-sourcing or other “low cost” regions without detailing all the hidden yet inherent costs, some of which are discussed below. In either case, the foundational problem is they simply do not know their true costs to acquire the goods they are purchasing.

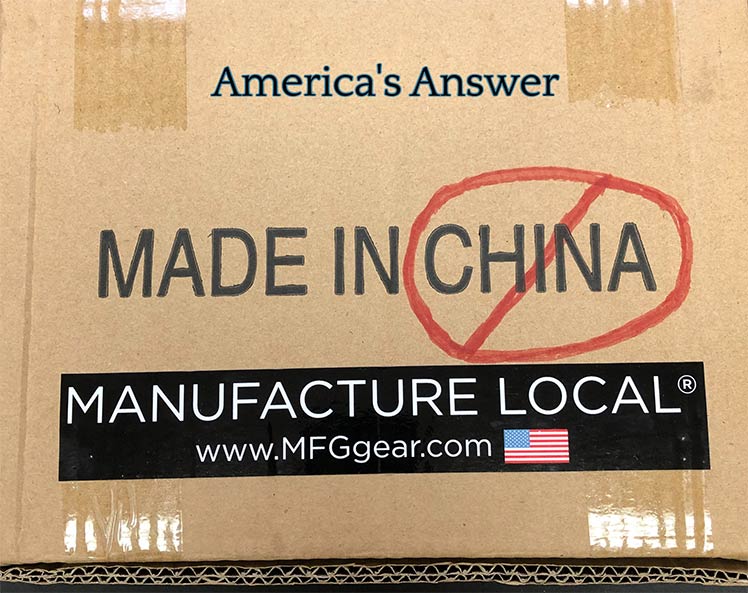

The contract manufacturer I have been a part of for the past 8 years works with companies that do understand the costs associated with outsourcing to offshore sources, otherwise we wouldn’t be in business. That is because we are 100% Made in the USA mechanical and electromechanical contract manufacturing mostly of life saving, life defending, and life changing products. Though we compete directly with sources in Asia, Mexico, and other regions, we win by offering a more dependable manufacturing service completely within our facilities and at a lower TOTAL COST, despite the unit prices of most offshore companies giving the illusion of being a bargain. Yes, the fact I have worked predominantly in US manufacturing means I have a bias. But biased or not, there is no valid argument against basic math, which is squarely on the side of Made in the USA.

So, let’s talk numbers and past examples. One larger customer years ago had routinely been purchasing hundreds of different custom sheet metal and machined parts and assemblies, but decided to migrate parts we were manufacturing over to Asian sources in order to hit a lower line item price on their purchase orders. In some cases, the Asian pricing was 30% to 50% of the best price we could offer. So, to them it made sense to migrate their product manufacturing offshore… right? Very quickly, their orders with us slowed and their business with us dropped off, though they as a company were growing rapidly. That lasted for the better part of a year, until they figured out the real costs from their Asian sources.

Customers of their size have resources that can be allocated towards determining the real costs they incur for each custom part that they procure. Where they had hoped for a sizable reduction in cost even factoring in customs, tariffs, freight, etc., they quickly realized their bottom line was being hit by expenses that went well beyond these basic costs which drove their average overall TOTAL COST for each outsourced part to actually increase by over 30% compared to using reliable US manufacturing. In other words, if they paid a US manufacturer $100 for a widget, Asian sources may have promised to charge them $30 for that same widget, but their average total cost to acquire the part from the Asian source ended up being over $130 per widget after factoring in all of the hidden money that offshore sourcing demands. The cherry on top came when they found replicas of their parts for sale on an auction site from an unrecognized China source.

So, what are those hidden costs associated with offshore sourcing?

Find out in Part 2 of “The Deception of Offshore Sourcing” coming soon.